19+ mortgage repayment

Web Mortgage insurance. A 30 year mortgage at 184 should cost you 1446 per month with 120804 in total interest.

Mortgages Backed By Federal Government Eligible For Deferred Payments Through Cares Act Due To Covid Abc7 Chicago

This may not apply if you were already behind on your mortgage when the COVID-19 forbearance was requested.

. Web Homeowners with federally backed loans have the right to ask for and receive a forbearance period for up to 180 dayswhich means you can pause or reduce your mortgage payments for up to six months. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web This loan modification aims to reduce your monthly mortgage payment amount by up to 20 by rolling missed or forborne payments into the total loan amount extending the mortgage term and for.

Web Younger Australians born in the 1990s are the most at risk as interest rates keep on rising with 31 per cent of Generation Z borrowers missing a mortgage repayment during the past six months. But with so many possible deals out there it can be hard to work out which would cost you the least. Web SHM must receive the COVID-19 Mortgage Assistance application to process your request for a COVID-19 Forbearance plan.

Mortgage customers experiencing financial hardship because of COVID-19 can apply for assistance. See if you qualify. Modifications repayment plans and forbearances.

Learn more about the program Check availability in your area Exit your forbearance English Español 中文. LawDepot Has You Covered with a Wide Variety of Legal Documents. For a borrower receiving a COVID-19 payment deferral or a disaster payment deferral where there is an escrow.

Additionally you can request an extension of forbearance for up to 180 additional days for a total of 360 days. Please return the 4-page application to SHMCovid19helpdcagagov. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Web In addition to the new payment deferral option borrowers with COVID-19 related hardships can still utilize other options that include reinstatement repayment plan or loan modifications based on their individual situations. Web A mortgage is one of the biggest commitments youll make in your financial life. The lender says you may be able to postpone your monthly payment with no late fees during the postponement period.

Use our mortgage repayment calculator to work out what your repayments will be based on how much youre borrowing the interest rate and fees of the deal and the term of the mortgage how long you have to pay it off. Lump Sum Repayment is Not Required in. Web During the COVID-19 national emergency however if you were current on your mortgage when the COVID-19 forbearance was granted your mortgage company should report your account as current.

Also known as private mortgage insuranceor PMIthis protects the lender in case you default on your mortgage. Web A mortgage is a major financial commitment so youll need to have a good idea of how much its going to cost you each month. SHM as a loan servicer of federally insured mortgages applauds the passage of the.

Visit PNCs Mortgage Payment Hardship Request to apply. Web CARES Act mortgage assistance programs Covid-19 mortgage relief The CARES Act which Congress passed in 2020 also included mortgage assistance programs. Web What its offering.

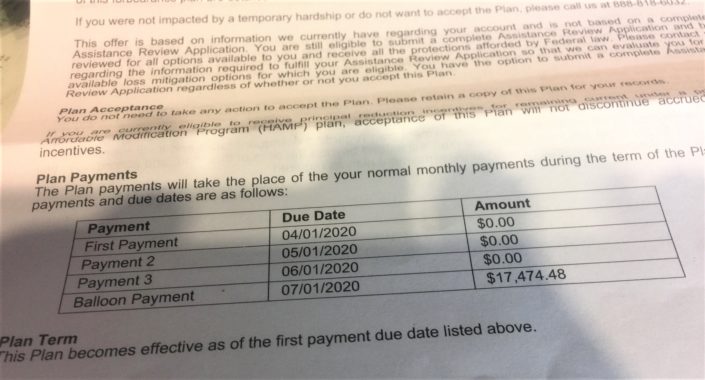

Ad Dedicated to helping retirees maintain their financial well-being. Web COVID-19 Advance Loan Modification ALM. Web The COVID-19 payment deferral may be the best option for you if your COVID-19 related hardship has been resolved and you are able to continue making your full monthly mortgage payment but cannot afford a full reinstatement or a repayment plan to bring your mortgage loan current.

Web A payment deferral brings your mortgage current and delays repayment of certain past-due monthly principal and interest payments as well as other amounts we paid on your behalf related to the past-due monthly payments. Web Apply for money to cover your mortgage Homeowners with financial hardships who have been impacted by COVID-19 can apply for assistance with their mortgage payments property taxes and other housing costs. Web 36 minutes agoSPFs Mr Harris said.

If you extend your mortgage term you could reduce your payments. You may be eligible for other options besides payment suspension forbearance. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Some of those provisions have expired. Understand Your COVID-19 Mortgage Options.

Web The CARES Act initially set forbearance protection to expire on Dec. Estimate your monthly mortgage payment. Web Provides Important Information about Post-forbearance Repayment Options to Help Impacted Homeowners.

Learn about other payment assistance options Reach out to us for help Call 1-800-219-9739 to request extend or end a forbearance. Web Make a payment with online banking call us at 1-800-219-9739 or mail your payment to the address on your monthly statement. WASHINGTON DC Fannie Mae FNMAOTCQB today announced COVID-19 payment deferral a payment deferral option for homeowners who experienced a financial hardship due to COVID-19 that has been resolved and are ready.

However the program has since been extended to March 31 2021 and more recently extended until June 30 2021. Create Your Satisfaction of Mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

The COVID-19 ALM is a permanent change in one or more terms of a borrowers mortgage that achieves a minimum 25 percent reduction to the borrowers monthly principal interest PI payment and does not require borrower contactServicers will proactively mail the modified mortgage documents to borrowers. A 30 year mortgage at 232 should cost you 1543 per. Our mortgage calculator helps by showing what youll pay each month as well as the total cost over the lifetime of the mortgage depending on the deal - you just.

See the below examples of some common 400000 home loans to understand how your interest rate can affect your mortgage repayments. It typically ranges from 058 to 186 of your total. Ad Developed by Lawyers.

For example 150000 mortgage on a repayment basis over 20 years at a rate of 4 per cent will cost. This option defers your missed payments to the end of your loan. Ad See how much house you can afford.

Web Compare Repayments on 400000 Mortgages.

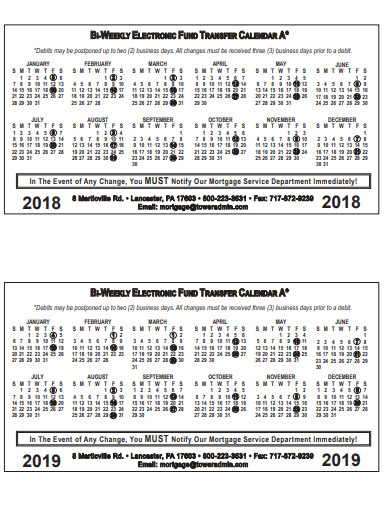

3 Biweekly Mortgage Templates In Pdf

Bc Mortgage Survey 2021 How Low Interest Rates Affect Existing Prospective Homeowners The Help Hub

3 Biweekly Mortgage Templates In Pdf

Free 9 Mortgage Statement Samples And Templates In Pdf

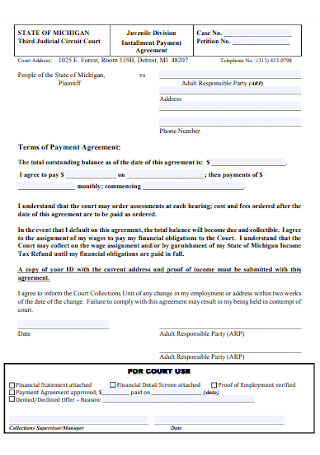

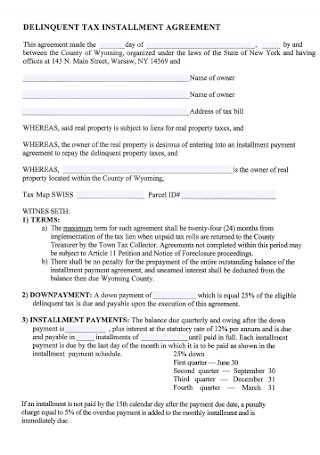

Sample Installment Payment Agreements 19 In Pdf Ms Word

How To Finally Pay Off Your Mortgage Wltx Com

Sample Installment Payment Agreements 19 In Pdf Ms Word

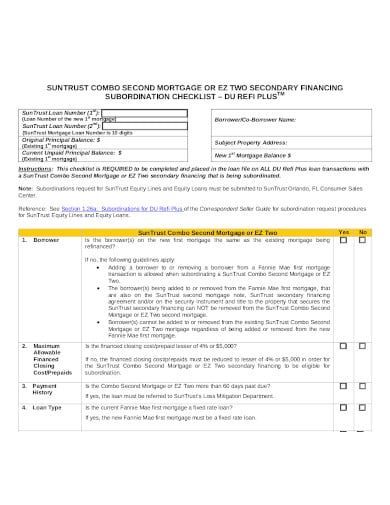

10 Secondary Mortgage Templates In Pdf Word

1545 Sheridan Boulevard Lakewood Co 80214 Mls 7728381 Zillow

Bc Mortgage Survey 2021 How Low Interest Rates Affect Existing Prospective Homeowners The Help Hub

Cares Act Mortgage Forbearance What You Need To Know Consumer Financial Protection Bureau

Mortgage Forbearance Vs Deferment What You Must Know

Covid 19 Mortgage Payment Relief Available City Of Mentor Ohio

The Coronavirus Cares Act Mortgage Forbearance Plan California Mortgage Broker

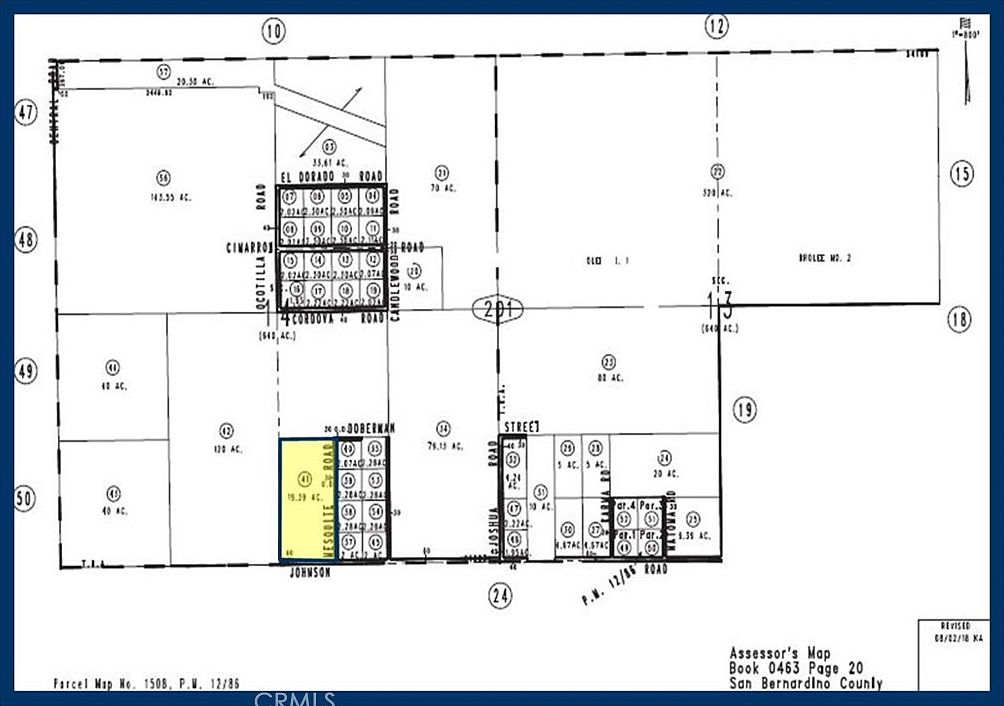

22828 Johnson Rd Apple Valley Ca 92307 Mls Hd23012390 Zillow

If Mortgage Forbearance Isn T Enough Consider These Options Money

Schedule In Google Sheets 19 Examples Format Sample Examples